Tort Coverage in Saskatchewan for Automobile Injuries.

In Saskatchewan, all drivers are required to have basic insurance coverage, which includes liability coverage, accident benefits, and personal injury protection. You can either choose No-Fault Coverage or Tort Coverage. In this blog post, we will take a closer look at Tort Coverage in Saskatchewan for automobile injuries.

What is Tort Coverage? Tort coverage is a type of liability coverage that provides protection to drivers if they are found to be at fault for an accident that results in injuries to other people. This coverage is designed to protect drivers from legal action that could result from an accident. If you are at fault for an accident that results in injuries to other people, your tort coverage will pay for the damages and injuries up to the limit of your coverage.

So, what exactly does Tort Coverage for Automobile Injuries cover? In Saskatchewan, this coverage is designed to provide compensation for three types of damages: non-pecuniary damages, economic loss, and loss of income.

Non-pecuniary damages are damages that are awarded to compensate for pain and suffering, loss of enjoyment of life, and loss of amenities of life. These damages are awarded based on the severity of the injury, the impact of the injury on the injured person’s life, and the duration of the injury.

Economic loss refers to the actual monetary costs that are associated with an injury, such as medical expenses, rehabilitation costs, and other out-of-pocket expenses that are incurred as a result of the injury.

Loss of income is a type of compensation that is awarded to injured parties who are unable to work as a result of their injuries. This compensation is designed to provide financial support to injured parties during their recovery period and until they are able to return to work.

It is important to note that Tort Coverage for Automobile Injuries does not provide coverage for property damage. This type of coverage is provided under a separate section of the basic insurance policy.

Bodily Injury Coverage Bodily injury coverage is a type of tort coverage that provides protection if someone is injured in an accident that you are at fault for.

Property Damage Coverage Property damage coverage is another type of tort coverage that provides protection if someone’s property is damaged as a result of the accident. This coverage can pay for repairs or replacement of the damaged property. Property damage coverage can also provide protection for loss of use, which covers the cost of renting a replacement vehicle or other property while the damaged property is being repaired.

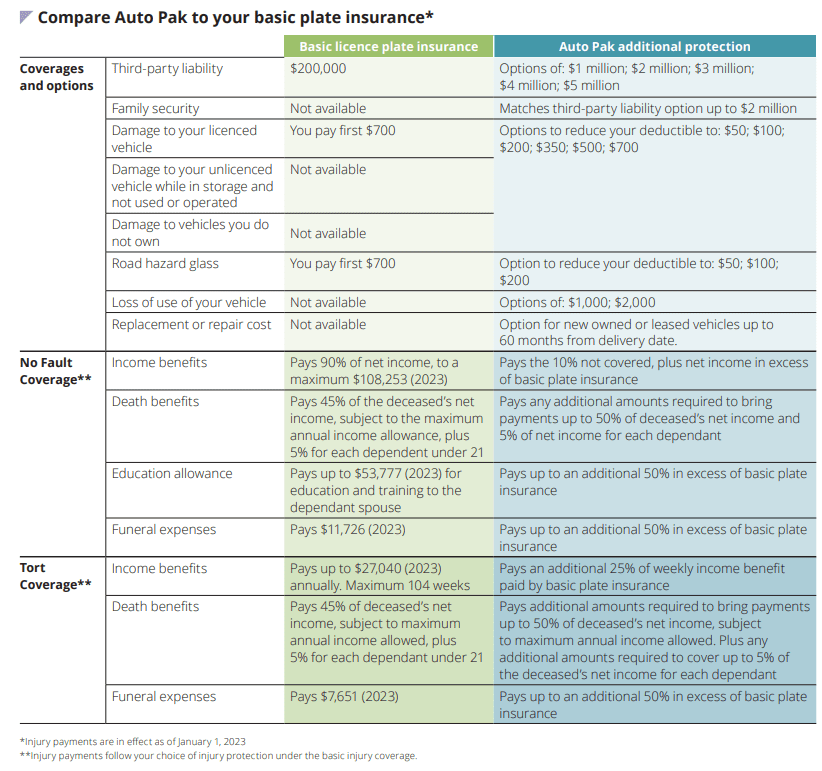

Tort Coverage Limits It is important to understand that tort coverage has limits to the amount of coverage that you can have. In Saskatchewan, the minimum amount of coverage that you are required to have is $200,000 for bodily injury and property damage. However, you can choose to increase your coverage limits if you want to have more protection.

Tort Coverage and Legal Action While tort coverage can provide protection in the event of an accident, it is important to note that it does not protect you from legal action that could result from an accident. If you are at fault for an accident and someone decides to sue you, your tort coverage will not protect you from this legal action. Instead, you will need to rely on your own legal representation to defend yourself in court.

Suing for Damages If you are injured in an accident that is someone else’s fault, you may be able to sue for damages. This can include compensation for medical expenses, lost wages, pain and suffering, and other damages that are incurred as a result of the accident. If you decide to sue for damages, you will need to prove that the other driver was at fault for the accident and that your injuries are a direct result of the accident.

In Saskatchewan, there are laws in place that limit the amount of damages that you can sue for. These laws are designed to prevent excessive payouts and to ensure that damages are fair and reasonable. If you are considering suing for damages, it is important to speak with a lawyer who can advise you on the best course of action.

It is important to understand your coverage limits and to make sure that you have enough coverage to protect yourself in the event of an accident. If you are unsure about your coverage or have questions about SGI Tort Automobile Coverage, it is always a good idea to speak with your insurance broker or you can also contact SGI directly. For your information, click here for a copy of the 2023 Guide to Tor Coverage.