Saskatchewan Automobile Injuries

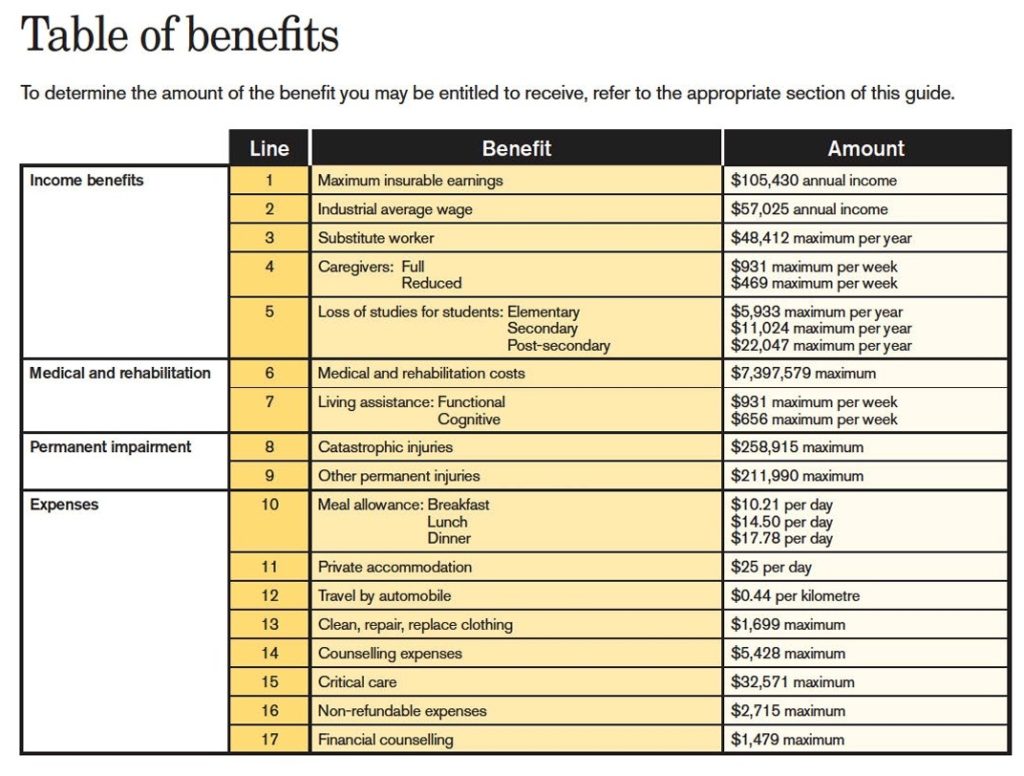

No Fault Coverage provides a comprehensive package of benefits to Saskatchewan residents injured in motor vehicle collisions, regardless of who’s responsible for the collision. SGI has some great information available to summarize and lay out the different coverages.

What is considered Permanent Impairment?

Impairment is considered permanent when a condition has stabilized during a period of time sufficient to allow optimal tissue repair and one where no further treatment will improve the condition.

It can include:

- a permanent acquired brain injury

- a permanent anatomical or physiological deficit

- a permanent disfigurement

- any other prescribed permanent impairment

What is not considered a permanent impairment?

- A disability

- Soft tissue injuries or whiplash injuries

- Pain, as it is subjective and cannot be measured objectively or validated

A customer who suffers a permanent impairment because of the accident is entitled to a lump-sum benefit for the permanent impairment.

When are permanent impairment and death benefits payable?

- Permanent impairment is payable to a customer to compensate them for a permanent physical or mental impairment and scarring or disfigurement from the accident, whereas death benefits are payable to the deceased’s family.

- If a customer dies from accident-related injuries and a permanent impairment benefit has not already been paid, the benefit is not payable following their death. In these cases, only death benefits are payable.

- Should the injured customer die from a cause unrelated to the accident, the lump sum permanent impairment benefit will be paid to the injured person’s estate. If the death is not accident related, the permanent impairment benefit is based on an estimate from the medical information available.

- If a customer dies from accident-related injuries and a permanent impairment benefit has already been paid, death benefits are payable in addition to these amounts. In these cases, death benefits are calculated in the normal manner and are paid in full.

Permanent Impairment benefits are not payable when:

- The customer is more than 50% responsible and was impaired

- The customer is more than 50% responsible and is convicted of a specified Criminal Code Offence

- The customer is more than 50% responsible, intentionally caused or attempted to cause bodily injury to another person, and they are convicted of a specified Criminal Code Offence

Income Benefits

If you’ve been injured in a motor vehicle collision, and that injury prevents you from performing all or most of the essential duties of your employment at the time of the collision, you’ll receive an income benefit.

The income benefit is based on your employment status at the time of your collision and replaces the salary you would be earning. Except in cases of the most serious or catastrophic injuries, the income benefit is usually a temporary measure to compensate for your lost wages while you recover from your injuries.

The income benefit ends when you can return to the work you were doing at the time of the collision or begin to earn income at the same level as at the time of your collision.

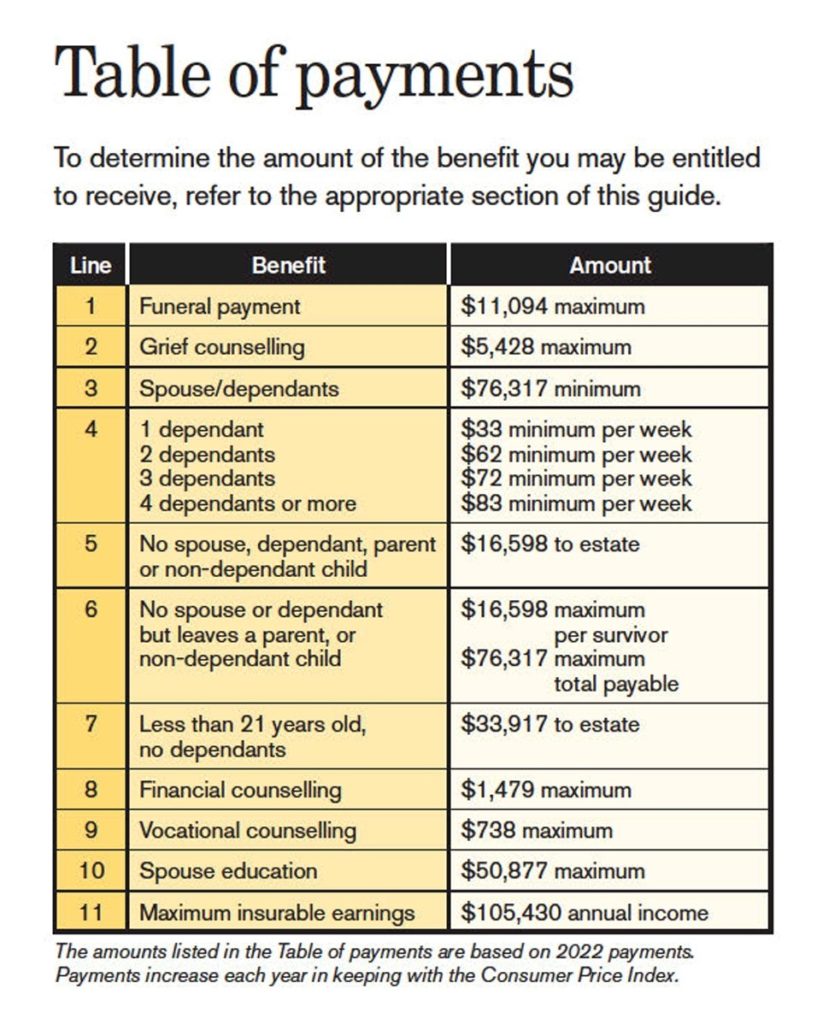

Payments in the event of a death

No Fault Coverage provides death payments to a surviving spouse, dependants, and in some cases, grown children and parents of a Saskatchewan resident who has died as a result of a collision, regardless of who is responsible for the collision.

Can I Sue?

Since No Fault Coverage is provided regardless of fault or collision circumstances, there are limited circumstances where the surviving spouse, parents or dependants have the right to sue.

Under No Fault Coverage, the surviving spouse and dependants may sue the responsible party for expenses in excess of the plan. An example would be if the surviving spouse or dependant suffer an income loss to the household in excess of the amount payable under No Fault Coverage. In limited cases, No Fault Coverage allows the spouse, parents or dependants to sue for certain bereavement damages. An example of this would include when the responsible driver is convicted of impaired driving, they would have the right to sue for grief and loss of care, guidance and companionship.

For more information contact SGI or click here for a copy of the 2023 Guide to No Fault Coverage.