Hoarding is more than just a cluttered space—it’s a complex mental health condition that can significantly impact home safety, health, and, importantly, insurability. As insurance professionals, it’s vital to understand what hoarding is, the levels it’s categorized into, and the serious risks it presents.

What Is Hoarding?

Hoarding disorder is recognized by the Canadian Psychiatric Association (CPA) as a mental health condition. Individuals who hoard have persistent difficulty discarding possessions, regardless of their actual value. This leads to excessive accumulation and clutter that disrupts the ability to use living spaces for their intended purpose.

While it’s easy to associate hoarding with messiness or poor housekeeping, it’s a deeply rooted psychological issue, often tied to anxiety, depression, trauma, or OCD. But beyond its emotional toll, hoarding creates a range of practical risks—from fire hazards to structural damage—and these risks directly affect insurability.

The 5 Levels of Hoarding

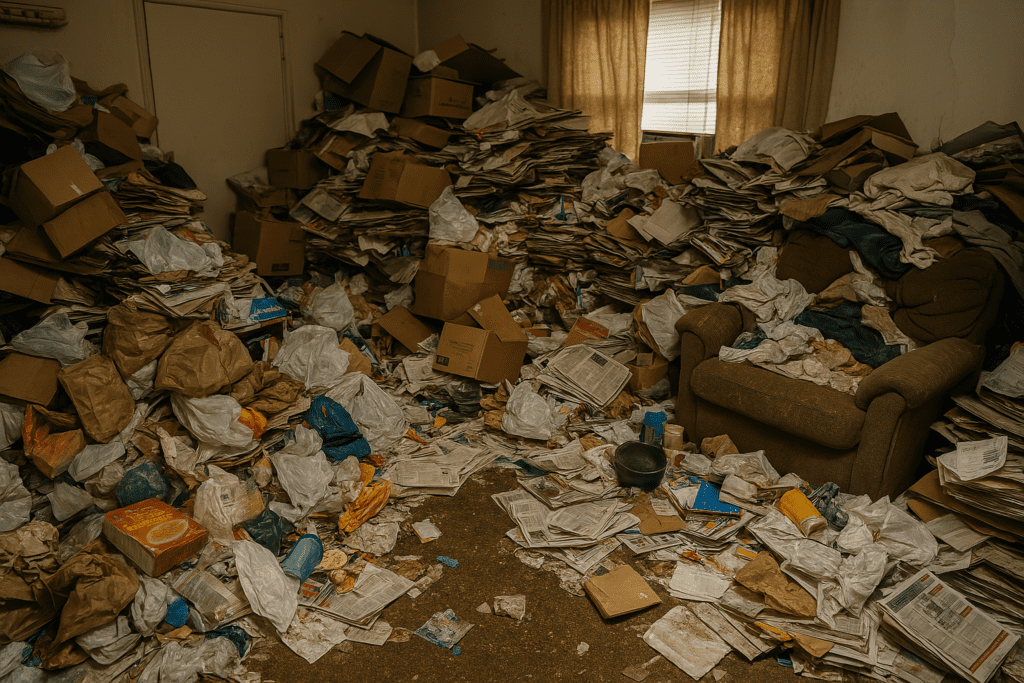

Hoarding is commonly categorized into five levels, ranging from mild to severe:

Level 1: Low Risk

- Home is clean and accessible.

- Light clutter with no noticeable odors.

- All entrances and exits are clear.

Insurance Impact: Minimal. Homes at this level present no unusual risks.

Level 2: Mild Hoarding

- One or two rooms are starting to be cluttered.

- Light mildew, pet odors, or noticeable dust buildup.

- Some signs of neglect, like dirty dishes or laundry pile-up.

Insurance Impact: Still generally insurable, though signs of deferred maintenance may raise questions during underwriting or claims.

Level 3: Moderate Hoarding

- Significant clutter in multiple rooms.

- Appliances may be broken or unsafe to use.

- Strong odors, excessive pet presence, or pest infestations.

Insurance Impact: Concerns grow. Fire risk increases, and there may be questions about liability and habitability. May affect eligibility or premiums.

Level 4: Severe Hoarding

- Major structural damage (rotting floors, broken windows, etc.).

- Blocked exits and hallways.

- Hazardous levels of mold, biohazards (like human or animal waste), and fire hazards.

Insurance Impact: Serious red flag. Homes in this condition may not be insurable until cleaned or repaired. Claims can be denied due to negligence or unaddressed risk factors.

Level 5: Extreme Hoarding

- No access to key living spaces (bedroom, kitchen, bathroom).

- Evidence of rodents, extreme decay, or structural collapse.

- Residents may be at risk of injury, isolation, or eviction.

Insurance Impact: Often deemed uninsurable. The risk to health, safety, and property is too high. May require intervention from health and social services before coverage can be considered.

A Mental Health Issue with Real-World Consequences

While hoarding is fundamentally a mental health condition, its effects spill into safety, health, and property risk—areas directly tied to insurance. As brokers, underwriters, and adjusters, we’re not mental health professionals, but we do have a responsibility to recognize when risk levels exceed safe or insurable thresholds.

In many cases, individuals who hoard do not seek help out of fear, embarrassment, or mistrust. That’s why it’s important for insurers to approach the topic with empathy and awareness. Working with local agencies, fire departments or community support programs can be an effective way to guide affected clients toward safety—and, ultimately, insurability.

Risk Management Tips for Insurers and Homeowners

- Conduct thorough inspections when possible, especially if there are signs of hoarding behavior.

- Encourage open dialogue—clients may be more willing to share if they don’t feel judged.

- Provide educational resources that connect clients with mental health support and clutter-cleanup services.

- Revisit coverage regularly as cleanup or remediation efforts may improve insurability over time.

In Summary

Hoarding is a sensitive but significant issue that blends mental health, home safety, and insurance risk. Understanding the five levels of hoarding allows us to better assess the situation, respond with empathy, and take appropriate steps to manage risk. A clean home is a safe home—and a more insurable one, too.